1600 paycheck after taxes

The advantage of pre-tax contributions is that. The new W-4 removes the option to claim allowances as it instead focuses on a five-step process that lets filers enter personal information claim dependents or indicate any additional income.

Mtidavis 1600 Paycheck After Taxes Definition

1600 after tax breaks down into 13333 monthly 3066.

. How much is 1600 after taxes. Ad Scalable Tax Services and Solutions from EY. It can also be used to help fill steps 3 and 4 of a W-4 form.

Also known as Net Income. Salary After Tax the money you take home after all taxes and contributions have been deducted. That means that your net pay will be 43041 per year or 3587 per month.

1600 a month after tax breaks down into 19200 annually 36797 weekly 7359 daily 920 hourly. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 1600 a month after tax is 1600 NET salary based on 2022 tax year calculation.

Learn What EY Can Do For You. 1600 after tax is 1600 NET salary annually based on 2022 tax year calculation. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

If your income is 1600 16k a year your after tax take home pay would be 160000 per year. 16k after tax Salary and tax calculation based on 202223 ATO tax rates and tax calculations - Full income tax and medicare deductions. This tax is not taken out of your pay.

Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. This is 13333 per month 3077 per week or 615 per day.

This is the price excluding taxes. How Your Texas Paycheck Works. The total cost of employing you to your employer is therefore 1600 which is your.

Youll pay 00 of your income. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 2021 Federal income tax withholding calculation.

If you earn 1600 in a year you will take home. It is an additional cost to your employer on top of your salary of 1600. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also.

Subtract 12900 for Married otherwise. If you make 55000 a year living in the region of New York USA you will be taxed 11959. 1720 1075 1600.

Some states follow the federal tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This is a break-down of how your after tax take-home pay is calculated on your 1600 yearly income.

BTax Value The Tax Value is equal to the Final Price minus the Before Tax Price so Tax Value 1720 - 1600 120. 1600 a month after tax is 1383 NET salary based on 2022 tax year calculation. The state tax year is also 12 months but it differs from state to state.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Tax example for 1600 using the Austrlia Tax. 1600 After Tax Explained.

Total Tax Due the sum of all taxes and contributions that will be. 1600 a month after tax breaks down into 16595 annually 31806 weekly 6361 daily 795 hourly.

How To Calculate Payroll Taxes Methods Examples More

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

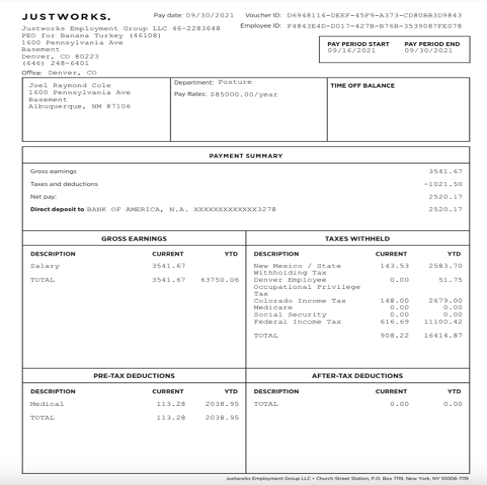

Questions About My Paycheck Justworks Help Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Net Pay Step By Step Example

Tkngbadh0nkfnm

401k Contribution Impact On Take Home Pay Tpc 401 K

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Gross Up Calculator Primepay

1 600 After Tax Us Breakdown August 2022 Incomeaftertax Com

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Mtidavis 1600 Paycheck After Taxes Definition

Bonus Calculator Percentage Method Primepay

Employee Cost Calculator Updated 2022 Employee Cost Calculation

How To Calculate Net Pay Step By Step Example

Mtidavis 1600 Paycheck After Taxes Definition

Basics Of Budgeting By Samson Floyd Audiobook Audible Com